|

|

|

|

|

BOOKSHELFKeeping Up with the Joneses

Shira Boss ’93, ’97J, ’98 SIPA

Shira Boss ’93, ’97J, ’98 SIPAPHOTO: WELLS P. WILSON

At a time when national savings rates are the lowest since the Great Depression, many Americans have become used to spending more than they can afford and racking up serious debt. This is in part because personal finance is not so personal, as freelance journalist and CCT contributing writer Shira Boss ’93, ’97J, ’98 SIPA explains. “I see personal finance as incredibly social,” she says. “We’re busy comparing ourselves to those around us, which means a lot of guesswork regarding other people’s money. In the meantime, we’re hiding our story from others, whether we’re stressing over debt or feeling guilty because we’re wealthy or feeling like we’re not measuring up because we’re living within our means and can’t have the higher lifestyle of those around us.” This unconventional social approach to spending sets apart Boss’ book, Green with Envy: Why Keeping Up with the Joneses Is Keeping Us in Debt ($24.95, Warner Business Books), from other personal finance books. Boss peeks into the lives of “the Joneses” — whether they be a suburban family, national politicians, baby boomers or billionaires — to understand what puts Americans in debt. Boss was led to write the book by friends who knew of her interest in finance, some of whom had received her unsolicited advice. However, it was the circumstances of her life that made Green with Envy into a book of social investigation, defining the financial relationship between households and the outside world. “Because of what was going on in my life — I was hiding financial stress and feeling envious of our neighbors and friends who seemed to have a more comfortable life — I realized there is this huge part of our financial well-being that nobody ever talks about,” explains Boss, who documents her experiences in the first chapter. Boss started the book’s case studies with her next-door neighbors: She sat down with them and said, “Tell me what’s really going on with your finances.” She found it fun, describing each chapter as part of the process of solving a mystery. “I was amazed how much people will tell you when you ask, and ask for a good cause … It’s a relief to get things out in the open,” she says. “To catch up with the Joneses, we need to understand what’s really going on with them, and what we do and don’t want from their lives.” Boss’ key advice is to realize that financial well-being can be improved without making more money and spending it — it’s a matter of perspective. Part of financial responsibility involves keeping in perspective the American idea of success as having luxury, as well as recognizing how well-off we already are. Boss explains the social side of finances using real examples, including one family that lived far beyond their means. “They tried to keep up on credit,” she says. “The husband said, ‘We thought everyone else could afford it easily, and even wondered why it was so hard for us.’”

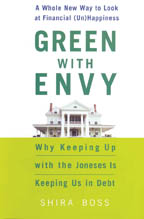

Green with Envy: Why Keeping Up with the Joneses Is Keeping Us in Debt by Shira Boss ’93, ’97J, ’98 SIPA

Green with Envy: Why Keeping Up with the Joneses Is Keeping Us in Debt by Shira Boss ’93, ’97J, ’98 SIPA

A native of Flint, Mich., Boss majored in economics and political science at the College while writing news and book reviews and covering the arts for Spectator . Boss has been an independent journalist for 12 years, writing in a variety of fields, including education, arts, technology, business and finance. She has served as a foreign correspondent in Turkey for The Christian Science Monitor and contributed to Forbes.com, Crain’s New York Business and The New York Times . Living on the Upper West Side, Boss maintains a forum on the book’s website, where she hopes people will share their envy or realization stories and use it to improve their financial lives. She hopes to speak to groups about financial concerns, encouraging people to realize that they are not alone in their money issues and to speak openly about them. While Boss already is working on her next book proposal, she still is focusing on Green with Envy’s message. “We can’t ignore those around us, but we do need to think more skeptically about their situations,” she says, “or break the money taboo and come out and ask.” Maryam Parhizkar ’09

|

|

||||||||||||||||||||||||||||